Hello There In !

Looking for your dream home? Get a verified approval right now.

Tired of giving your personal information over the phone? Tired of your phone blowing up after simply filling out a form online? We’ve changed the outdated mortgage pre-approval process. Give it a try - there’s no obligation.

-

Download a pre-approval letter to submit to a Realtor in minutes.

-

Edit the amount yourself if your offer changes.

-

Know your rate and loan options before you commit to a loan.

-

Show the seller you’re approved and ready to buy.

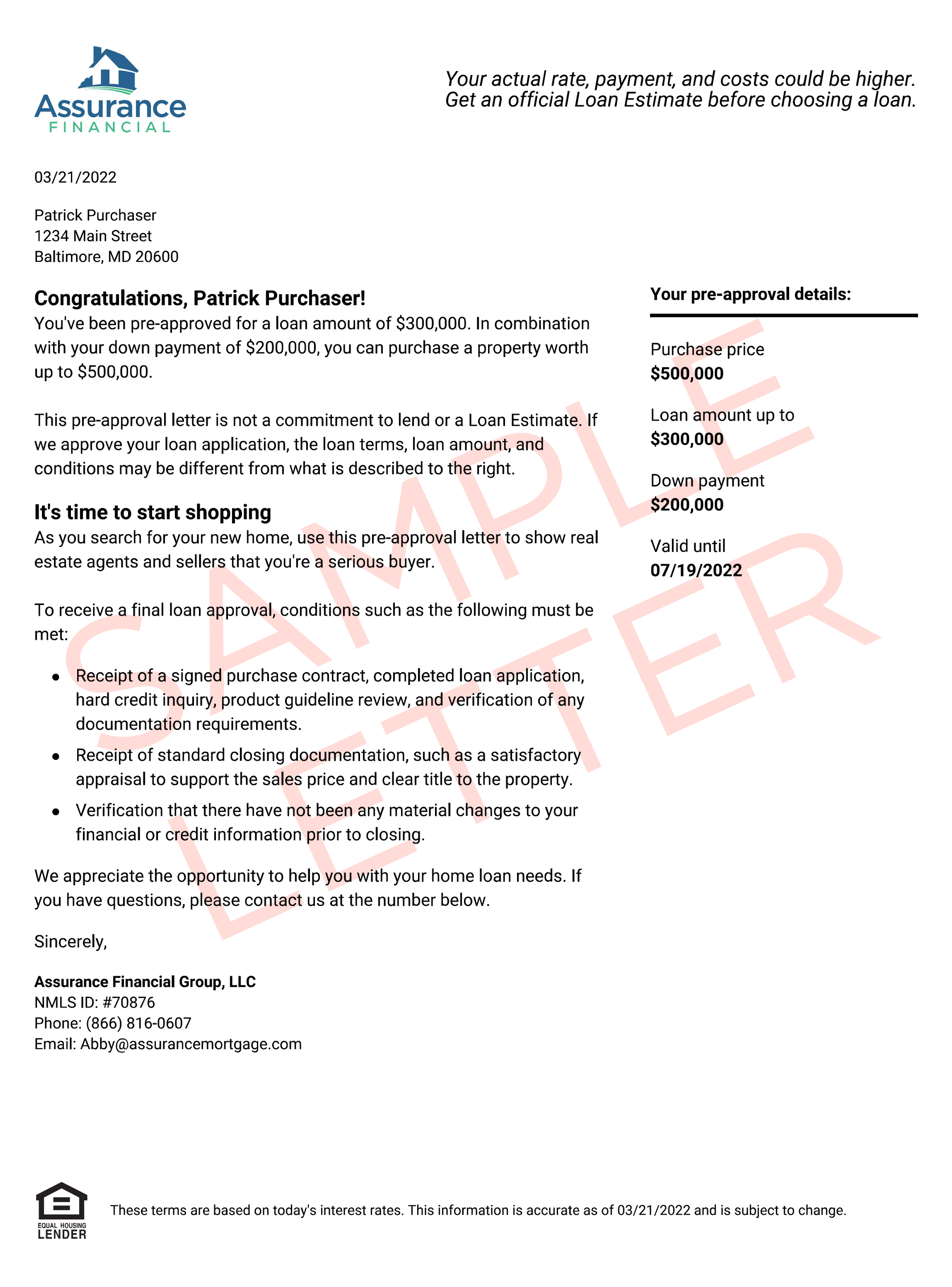

See what you're getting!

Roll over image to zoom in

Tap to zoom in

Complete the online application in only 15 minutes.

-

Provide your correct social security number.

More

We will need your accurate SSN number (and your co-borrowers if you have one) to run your options.

-

State your accurate income.

More

Include any bonuses, commissions, child support, etc. to get the accurate estimate. If you’re self employed it may be best to call us first at 866-790-7980.

-

Tell us how much money you can put down.

More

First-time home buyers may be able to put down as little as 3% of the home price. Sometimes the more you put down the lower your rate may be. Just use the amount you prefer as you can change this later.

-

Select your loan type and rate.

More

You will be offered loan options. For example, 20-year fixed, 30-year fixed, etc. so you can choose the right loan, rate, and payment for your situation. Don't worry, you can change your mind anytime before we lock your loan. You will need to speak with our licensed agent to lock your loan.

We’ll pull your credit to get you approved fast.

-

We’ll pull a tri-merge credit report.

More

We will pull your credit information from Experian, Trans-Union, and Equifax. This is considered a hard pull on your credit report. You have the right to ask us for your report.

-

Then, we’ll run automated underwriting.

More

Our automated system will do an analysis based on your information and selection to provide an online pre-approval. You may be qualified for different options or even a higher loan amount, so feel free to call us to discuss the possibilities.

-

And just like that, we’ll make a decision on your loan approval.

More

After completing the online application, in less than 1 minute you’ll have an answer on your approval. If you are pre-approved, you will see a downloadable letter (you may need to refresh your page). If you do not see this alert within 5 minutes, please call us at 866-790-7980. We may still be able to qualify you for a loan.

Download your pre-approval letter instantly.

-

If approved, you’ll get a congratulations notice.

More

The congratulations alert will appear in the top right of your screen in less than 1 minute. If you are pre-approved, you will see a downloadable letter. If you do not see this alert, you still may be able to get approved. Please call us at 866-790-7980 to learn your options.

-

You can edit the offer amount on your letter yourself.

More

We know home loan offers can go back and forth. As long as it’s for a lower amount, you will have the ability to edit the amount of the offer. If you realize you need a higher loan amount, please call us to adjust your approval for free at 866-790-7980.

-

Download your letter instantly to send to your Realtor.

More

Your letter will be in the form of a PDF document that you can download and forward to your Realtor and/or co-borrower.

Still have questions about getting pre-approved?

Chat with Abby now. She’s standing by to help you. Or give us a call at 866-790-7980.