Getting a mortgage should be easy. We figured out the secret.

RESOURCES

Downloadable Guides

We’ve created these guides to be a valuable resource to walk you step-by-step through your next adventure.

-

First-Time Homebuyer Guide

497.68 KiB

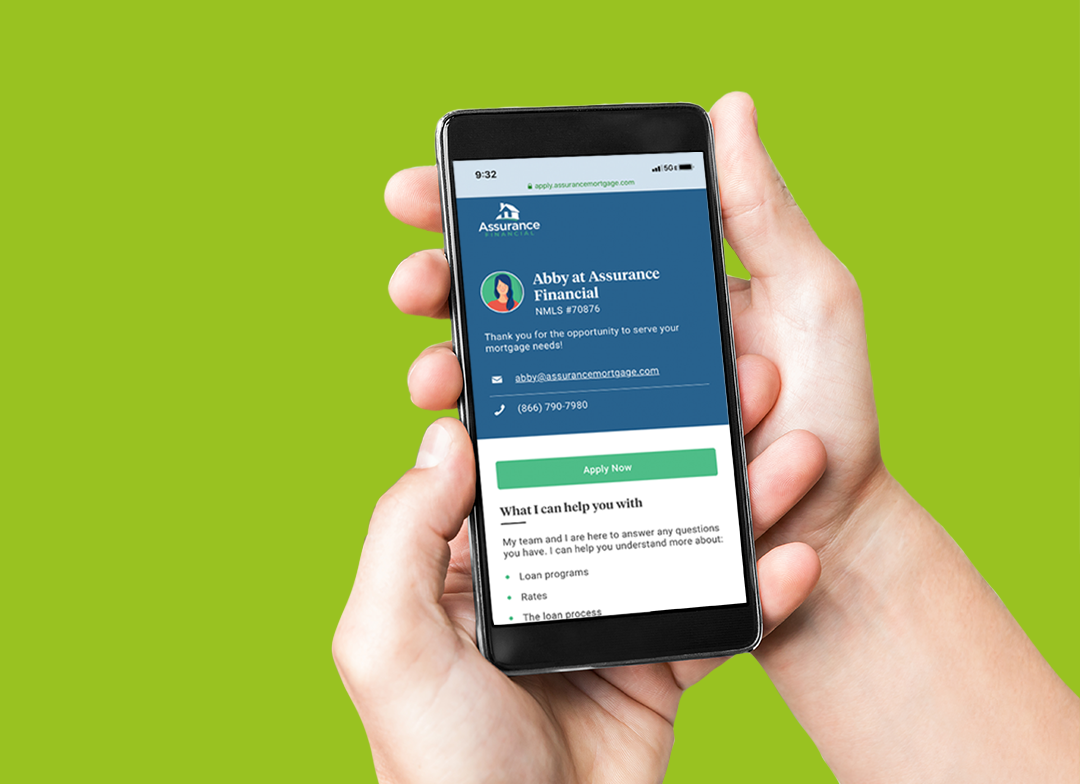

Enjoy your guide! You’re smart to research your mortgage options. If you have more questions, Ask Abby anytime or call us at 1-866-790-7980.

Click here to download the file -

Refinance Guide

483.52 KiB

Enjoy your guide! You’re smart to research your mortgage options. If you have more questions, Ask Abby anytime or call us at 1-866-790-7980.

Click here to download the file

Your Mortgage, Your Way.

Our loan process was designed with your needs in mind first. And we think it's great. Why? 15-minute digital applications, real-time updates, better processing times, fast closings, and amazing people to guide you through the whole way. Here's how it works:

1. Apply in 15 Minutes

Complete your online application as thoroughly as possible. A licensed loan officer can help you with any questions you may have. Once you get a pre-approval, we'll add initial disclosures to your online account to eSign them after you speak with our agent to confirm your loan options.

3. Appraisal

Not all loans require an appraisal, but we will order one for your property, if needed. You'll receive a call from an appraiser to set up an appointment and pay through our appraisal system. Don't worry, you will receive a copy of the full appraisal. In the meantime, we will still be working away on your loan.

4. Underwriting

Your loan is moving forward for formal review. If you already received an online pre-approval, this will be even faster! Either way, an underwriter in our office will determine if all requirements for a mortgage meet the guidelines for your loan type. Be looking for a decision from us soon.